��ϵ��ʽ

more��������Ӣ������

- 2016-05-27Ӣ��������ѧ˶ʿ�γ�assig..

- 2016-04-15��Դ����������Ʒ�γ���ҵ

- 2013-08-26���ô����ѧר����ҵ��can..

- 2013-08-26����ѧר����ҵ�����ʱ䶯��..

- 2013-08-10����ũ��������۷�����о�..

- 2013-07-10university of manchester��..

- 2012-06-24there are two stylized fa..

- 2012-05-23Ӣ����ҵ���ģ�options por..

- 2012-02-23Ħ�г��ı��շ��ʽ���ģ����..

- 2011-07-05���ڴ��ģ���Ƶijɱ�����ģ..

more��������

- 2011-03-11��д��ѧ������ѧ���ģ�the..

- 2011-01-25��ѧ����ҵ����������ѧ��..

- 2011-02-16private housing mortgage ..

- 2011-07-05���ڴ��ģ���Ƶijɱ�����ģ..

- 2010-05-20financial mathematics

- 2011-01-16�Ĵ�������ѧ������ѧ���Ķ�..

- 2011-02-24��д��ѧ������ѧרҵ�γ���..

- 2011-01-24ʵ֤���ڣ�ƽ������IJ���ģ..

- 2011-02-18data envelopment analysis..

- 2011-02-11��ѧ������ѧרҵ��ѧ��ģ��..

more��ѧ����д��ָ��

- 2024-03-31��ɭ•����˹С˵��..

- 2024-03-28��������Ů����������˼����..

- 2024-03-27����·�����ء�֯�����ϡ���..

- 2024-03-21��Խ���ӣ��ۡ����������ˡ�..

- 2024-03-19�����˱���•�Ѷ�����..

- 2024-03-13�������֮�á����ӿ�������..

- 2024-02-22��ѧ����ѧ�ӽ��µġ�ӡ��֮..

- 2023-05-03Ӣ�������ʶ���֮���ݴ�����..

- 2023-02-07Ŀ����������5g��the futur..

- 2022-07-04����Ӣ�����������ѧϰ�ߵ�..

��Ӣ���ʷ��� Analysis of performance of exchange rate between Sterling and Chinese RMB

�������ߣ���ѧ�������������ԣ�˶ʿ��ҵ���� dissertation�dz�ʱ�䣺2010-09-07�༭��vshellyn����ʣ�7735

�������������ı�ţ�org201009072223461138���֣�Ӣ�� English������Ӣ���۸�$ 44

�ؼ��ʣ����ʷ���Analysisperformanceexchange rate between SterlingChinese RMB

Analysis of performance of exchange rate between Sterling and Chinese RMB

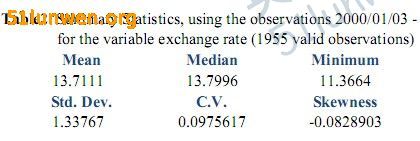

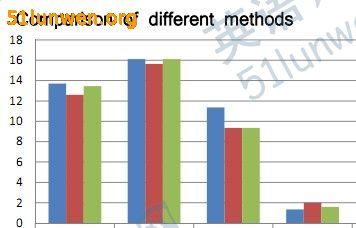

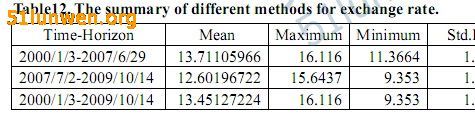

This paper examines performance of exchange rate between Sterling and Chinese RMBrom January 3, 2000 to October 14, 2009. There are two time-horizon for the trend ofxchange rate between pound and Chinese RMB. The main analysis methods for trendnalysis of these two currencies are basic statistical analysis, such as mean, maximum,minimum, standard deviation and variance. I find that range of data has a critical influence tootal trend of exchange rate. The external nation��s economic development and financial eventsdirectly affect the performance of exchange rate.

Keywords: exchange rate; trend; time periods; analysis.

1. Introduction

International foreign exchange market (international currency markets.) is an important component of the international financial markets, which play a vital role inthe world economy. The function of the foreign exchange market is to help businessesconvert one currency to another. The most trading currency in the internationalforeign exchange market is United States Dollar(USD($)), Euro(EUR(�)), JapaneseYen(JPY(¥)), Pound sterling(GBP(£)), Swiss Franc (CHF (Fr)), Chinese Yuan(RMB(��)) and so on. What factors affect an exchange rate? According to some study,��factors that affect foreign exchange rates are determined by supply and demand forcurrencies.�� (Berko, E, 2009).

Supply and demand are influenced by factors in theeconomy, such as Financial and political stability, Monetary policy, foreign trade,interest rate foreign exchange reserves and the activities of international investors.��Capital flows, given their size and mobility, are of great importance in determiningexchange rates.�� (Berko, E, 2009).This paper examines performance of exchange rate between Sterling and ChineseRMB from January 3, 2000 to October 14, 2009. First time periods from 3/01/2000 to29/06/2007 is a gradual upward trend and second periods from 2/07/2007 to14/10/2009 is a dramatic downward trend. Section 2 I introduce the background-thepound sterling and Chinese Yuan and analysis. I analyzed the performance of theexchange rate between pound and Chinese RMB over the two periods in section 3andsection 4. Section 5 is Outline of overall trend of exchange rate. Finally, in section 6I summarise the performance of exchange rate and give my conclusion.

1. Introduction

2. Background: The Pound sterling and Chinese RMB and analysis methods.

3. Data analysis of first time periods- 3/01/2000 to 29/06/2007.

4. Data analysis of second time periods- 2/07/2007 �C 14/10/2009.

5. Outline of Data analysis of two time periods- 3/01/2000 to14/10/2009.

6. Conclusion

Bibliography:

Berko, E. (2009) Factors that affect foreign exchange rates. Retrieved November 5, 2009,

from <https://e-articles.info/e/a/title/Factors-that-Affect-Foreign-Exchange-Rates>.

Junhua, H, 2009. The fourth anniversary of the exchange rate reform, RMB has appreciated

15.77%. Retrieved November 15, 2009, from

<https://news.hexun.com/2009-07-23/119866042.html>.

The People's Bank of China, (2009) Statistics. Retrieved November 5, 2009, from

<https://www.pbc.gov.cn/diaochatongji/tongjishuju/gofile.asp?file=2009S09.ht��������Ӣ���������ṩ�������ṩ���Ĵ�д��Ӣ�����Ĵ�д����д��������дӢ����������д��ѧ����������дӢ����������ѧ�����Ĵ�д��غ��Ĺؼ���������

�������

- һ�����͵�ŷ������Ч�ʵ�DEA������ʵ֤�о�:A case study of DEA analysis for large European bank efficiency

- ��ѧ������ѧרҵ�γ�����д������Empirical Finance��Analysis of long memory and non-stationary processes

- Data Envelopment Analysis��Data Envelopment Analysis (DEA) is an increasingly popular management tool

- Empirical Finance��Analysis of non-stationary processes II: long-run relationships in empirical finance

- Private Housing Mortgage Loan Risk Analysis for Bank of Communications Jiujiang Branch

��google���Ҹ�����Ӣ���ʷ��� Analysis of performance of exchange rate between Sterling and Chinese RMB

Ӣ��

Ӣ�� �Ĵ�����

�Ĵ����� ����

���� ���ô�

���ô� ������

������ �¼���

�¼��� ���

��� �ձ�

�ձ� ����

���� ����

���� �¹�

�¹� ������

������ ��ʿ

��ʿ ����

���� ����˹

����˹ ������

������ ��������

�������� �Ϸ�

�Ϸ�